Events

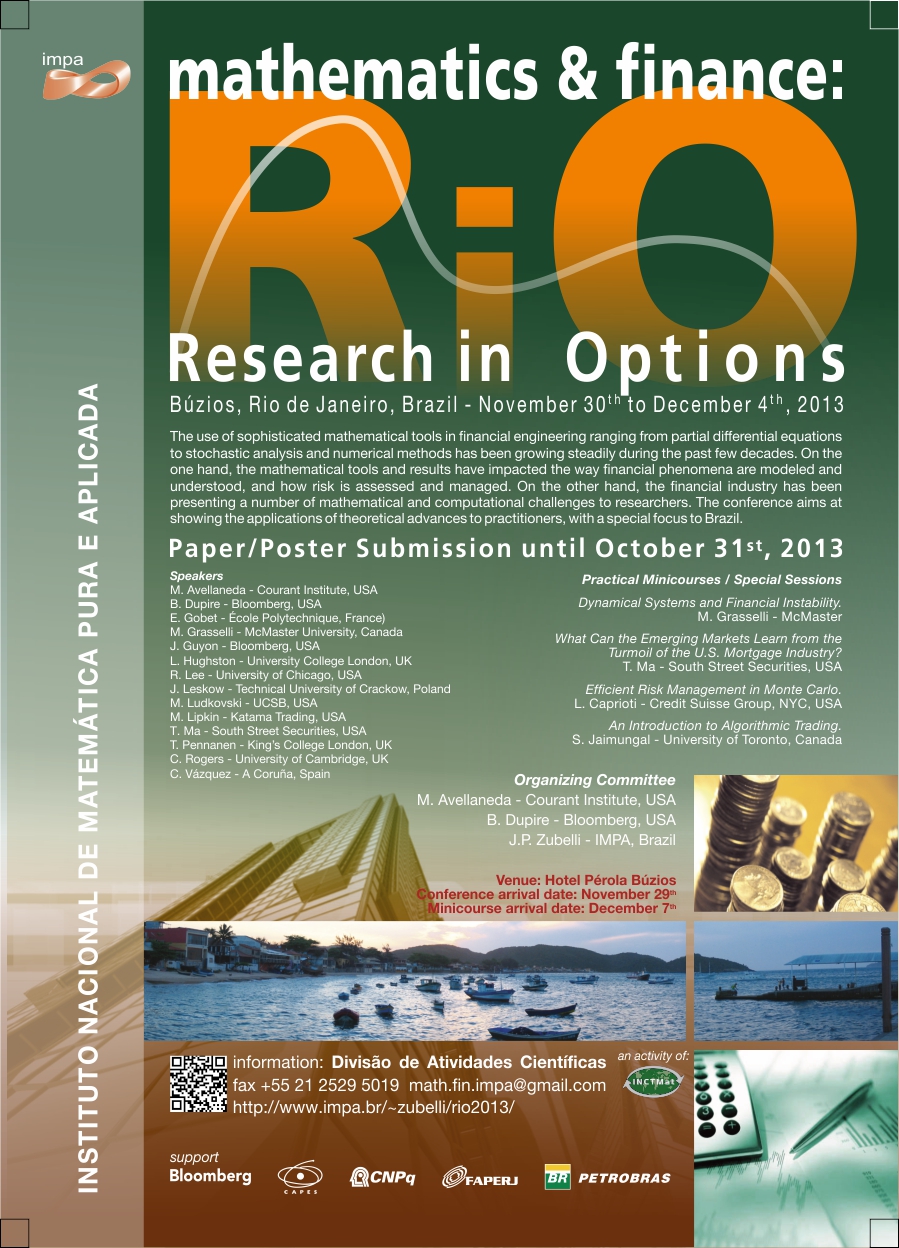

The use of

sophisticated

mathematical tools in financial engineering ranging from partial

differential equations to stochastic analysis and numerical methods has

been growing steadily during the past few decades. On the one hand, the

mathematical tools and results have impacted the way financial

phenomena are modeled and understood, and how risk is assessed and

managed. On the other hand, the financial industry has been presenting

a number of mathematical and computational challenges to researchers.

We will precede the conference with two days of minicourses. The minicourses will be aimed at both practioners and students.

Organizing Committee:

International Participants:

Marco Avellaneda (Courant Institute, USA)

Carole Bernard (Waterloo University, Canada)

John Chadam (University of Pittsburgh, USA)

Raphael Douady (Riskdata, USA)

Bruno Dupire (Bloomberg, USA)

Ernst Eberlein (University of Freiburg, Germany)

Matheus Grasselli (McMaster University, Canada)

Emmanuel Gobet (École Polytechnique, France)

Julien Guyon (Bloomberg, USA)

Lane Hughston (Brunel University London, UK)

Sebastian Jaimungal (University of Toronto, Canada)

Roger Lee (U. Chicago, USA)

Terence Ma (South Street Securities, USA)

Teemu Pennanen (King's College, UK)

Chris Rogers (Cambridge, UK)

Uwe Schmock (T.U. Vienna, Austria)

Martin Schweizer (ETH Zurich)

Carlos Vázquez (A Coruña, Spain)

Lakshithe Wagalath (IESEG, Paris)

Minicourses (Saturday and Sunday):

Matheus Grasselli (McMaster University, Canada): Dynamical Systems and Financial Instability - new modelling insights and empirical validation.

Sebastian Jaimungal (University of Toronto, Canada): Algorithmic and High Frequency Trading: Data, Models and Methods.

Lakshithe Wagalath (IESEG, Paris): Systemic Risk and Fire Sales.

To register

please follow this link.

Registration Fees (due upon arrival).

Industry (and

others that are not in academy):

R$ 1000

Academic:

R$ 200

Students:

R$ 40

Venue: Hotel Atlantico Buzios

IMPORTANT: RESERVATIONS TO GET THE GROUP RATE SHOULD BE MADE THROUGH

OUR TRAVEL AGENT (

micheleleite@mmxcongressos.com )

Please do make a copy to math.fin.impa@gmail.com of such communications.

IMPORTANT NOTE TO INDUSTRY PARTICIPANTS: PLEASE MAKE YOUR

RESERVATION

ASAP. WE CANNOT GUARANTEE AVAILABILITY OF HOTEL SPACE FOR RESERVATIONS

AFTER 15/10/2014. WE URGE YOU TO MAKE YOUR RESERVATION BEFORE THIS

DATE.

Arrival, Departure and Transportation:

The arrival date for those that will participate in the minicourses is Friday (Nov. 28), and on Sunday (Nov. 30) for all others.

A bus will depart from IMPA on Friday and Sunday, November 28 and

30th, respectively, at 3PM (TBC) and will return to IMPA in the

morning of December 4th. The trip takes about 3 hours. Registered

participants are welcome to join the bus on either way. To do that

please make sure you register and send a message to eventos@impa.br

with subject "transportation". Participants requiring special

arrangements due to time or physical constraints are kindly requested

to contact us at the above email for further information..

Poster Session

We will hold a poster session during part

of the evenings so as to encourage the contribution of research and

projects currently developed by students. Posters should be sent to math.fin.impa@gmail.com

using Poster Session as

subject. The standard adopted for posters is size A0 vertical.

Deadline for submission of posters: September 30th, 2014.

Contributed Communications

We will have a number of thematic

sessions on topics of interest. To cite a few: Option Pricing,

Portfolio Optimization, Risk Management, Real Options. These sessions

will be composed of contributed communications of 30 minutes.

Contributions should be sent to math.fin.impa@gmail.com

using Contributed

Communications as subject.

Deadline for submission of the contributions and posters: September 30th, 2014.

Proceedings and abstracts - Call for papers

Deadline for submission of the contributions and abstracts: September 30th, 2014.

Student Participation

Deadline for application for student support: September 30th, 2014.